PriceVol’s pulse on market volatility

MCCAIG/iStock via Getty Images

Levels of market volatility elevated this week as the S&P 500 declined 4.25% and Fed Chair Jerome Powell announced a 75-basis point rate hike.

In turn the CBOE Volatility Index (VIX) touched as high as 35 and ended the week at 31.1. At the same time, PriceVol, a proprietary instrument of market risk developed by ASYMmetric ETFs, maxed out on the week at 6.6 and closed at 6.5.

PriceVol was invented to provide a more precise measurement of market volatility as it measures the realized volatility and price movements of 100% of the S&P 500, delivering investors a more granular view of volatility. Learn more about PriceVol.

Where Was Volatility Seen?

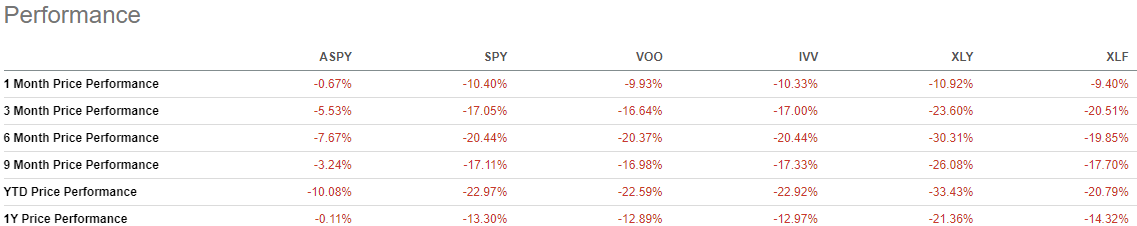

Benchmark ETFs that mirror the S&P, such as the SPDR S&P 500 ETF Trust (NYSEARCA:SPY), iShares Core S&P 500 ETF (NYSEARCA:IVV), and Vanguard 500 Index Fund (NYSEARCA:VOO), experienced increased levels of volatility across the board.

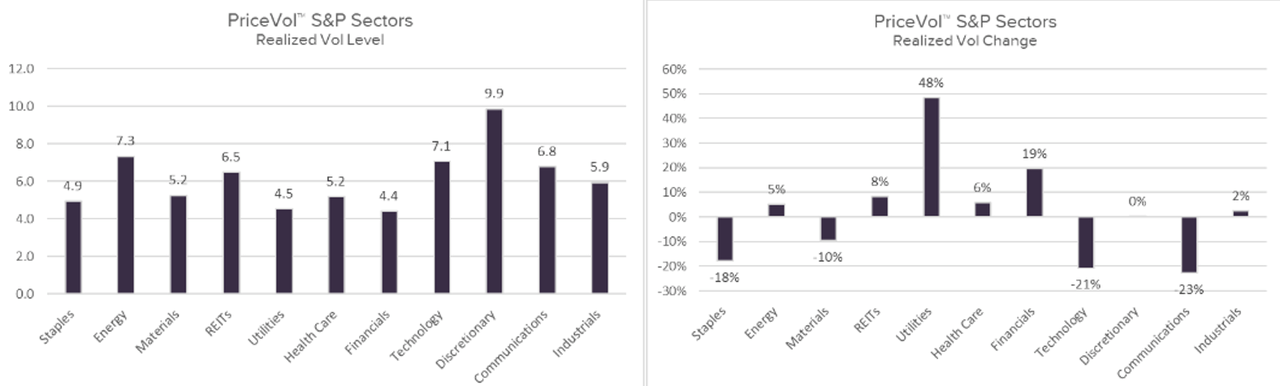

From a sector vantage point, the consumer discretionary (XLY) market segment experienced the highest realized volatility levels at 9.9. At the same time the financial (NYSEARCA:XLF) segment of the market had the lowest level of realized volatility at 4.4 but did experience one of the largest rates of change from the previous week at 19%. See visual representation below:

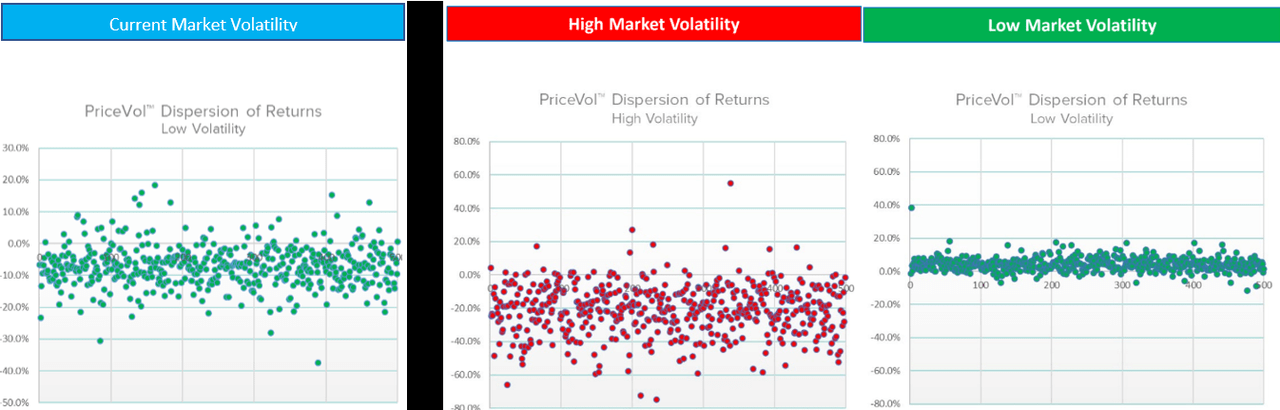

Furthermore, since PriceVol measures all constituents of the S&P 500 it allows investors to get a gauge of how the disparity of returns was observed on the week. See below what the current dispersion of returns looked like on the left compared to a traditional low and high market volatility setting.

An ETF designed to protect against market volatility is the ASYMmetric S&P 500ETF (ASPY). ASPY is a rules-based, quantitative long/short hedging strategy that seeks to deliver the financial community a shield against bear market declines, by being net short, while also seeks to capture the majority of bull market gains, by being net long.

See below the performances of all five ETFs discussed across multiple time frames along with the complete PriceVol data for the month of May.